Financial Ratio Analysis Calculator

Use the Leverage of Assets Calculator above to calculate the leverage of assets and Du Pont ratios from your financials statements. Leverage of Assets measures the ratio between assets and owner’s equity of a company. Asset Turnover (Du Pont) measures a firm’s efficiency at using its assets to generate sales revenue, the higher the better.

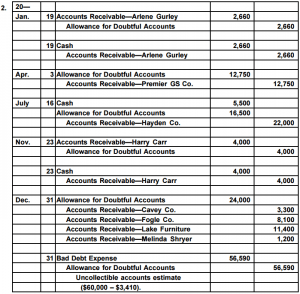

ROA gives an idea as to how efficient management is at using its assets to generate earnings. The financial ratios available estimating allowance for doubtful accounts by aging method can be broadly grouped into six types based on the kind of data they provide. Using ratios in each category will give you a comprehensive view of the company from different angles and help you spot potential red flags. Sustainable Growth Rate is the maximum growth rate of a company if none of its ratios change and it does not raise new capital through selling shares.

First, ratio analysis can be performed to track changes within a company’s financial health over time and predict future performance. Third, ratio analysis can be performed to strive for specific internally-set or externally-set benchmarks. Instead, the values derived from these ratios should be compared to other data to determine whether a company’s financial health is strong, weak, improving, or deteriorating.

Ratio Analysis Calculator

For example, net profit margin, often referred to simply as profit margin or the bottom line, is a ratio that investors use to compare the profitability of companies within the same sector. It’s calculated by dividing a company’s net income by its revenues and is often used instead of dissecting financial statements to compare how profitable companies are. Analysis of Leverage is used to evaluate how effectively management is using borrowed funds to make a return for income. Typically, funds are raised by debt in order to enhance the return to shareholders. This is done by financing the company’s assets with debt, which requires a fixed payment of interest.

Liquidity Ratios

Asset Turnover measures a firm’s efficiency at using flexible budget report its assets to generate sales revenue, the higher the better. Use the Return on Assets (Profitability Ratio) Calculator above to calculate the profitability ratio from your financial statements. Financial Statements are prepared by companies to demonstrate its financial activity to stakeholders. These are prepared at regular intervals, and typically contain at least a balance sheet and an income statement.

What Is Ratio Analysis?

Gross Efficiency of Assets tells us how much income each dollar of assets generates before paying out taxes and interest. Profit Margin (Du Pont) is used to determine bookkeeping payroll services the profitability of each dollar of sales that company makes. Price to Book Ratio tells us the relative value the market places on the company to the accounting valuation. This ratio provides a basic understanding of residual value of a company should it go bankrupt. Use the Times Interest Earned Calculator above to calculate the times interest earned from you financial statements.

Gross Profit Margin (Gross Margin) is used to assess a firm’s financial health by revealing the proportion of money left over from revenues after accounting for the cost of goods sold.

- It doesn’t involve one single metric; instead, it is a way of analyzing a variety of financial data about a company.

- Ratio analysis is a method of examining a company’s balance sheet and income statement to learn about its liquidity, operational efficiency, and profitability.

- Use the Average Days Sales Calculator to calculate the average days sales from your financial statements.

- The quick ratio measures a company’s ability to meet its short-term obligations with its most liquid assets.

If the assets financed by debt generate pretax net income sufficient to repay this interest, then any additional net income is profit that goes to the shareholders. Consider the inventory turnover ratio that measures how quickly a company converts inventory to a sale. A company can track its inventory turnover over a full calendar year to see how quickly it converted goods to cash each month. Then, a company can explore the reasons certain months lagged or why certain months exceeded expectations.

The Dividend Yield shows how much a company pays out in dividends each year relative to its share price. In the absence of any capital gains, the dividend yield is the return on investment for a stock. Use the Debt to Tangible Net Worth Calculator above to calculate the debt to tangible net worth from your financial statements. Use the Debt Ratio Calculator to calculate the debt ratio from your financial statements. The Debt Ratio indicates what proportion of debt a company has relative to its assets.

The quick ratio measures a company’s ability to meet its short-term obligations with its most liquid assets. Determining individual financial ratios per period and tracking the change in their values over time is done to spot trends that may be developing in a company. For example, an increasing debt-to-asset ratio may indicate that a company is overburdened with debt and may eventually be facing default risk.